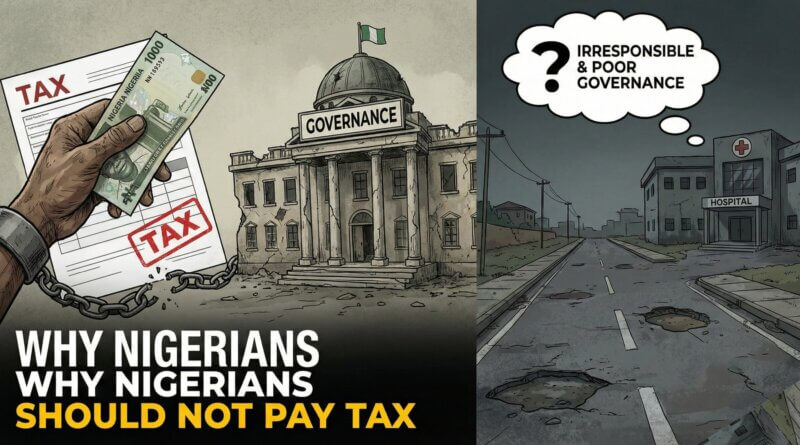

Why Nigerians Should Not Be Paying Tax: A Broken Social Contract

Introduction

Taxation did not begin as a sophisticated economic policy. It wasn’t born from complex financial theory or advanced government systems. Tax, in its earliest form, started as a survival mechanism , a simple way for rulers to gather resources to run their kingdoms when there were no alternatives.

But today, taxation has evolved into something deeper: a social contract. Citizens contribute to the state, and in return the state provides security, infrastructure, stability, and public services.

This exchange is the foundation of modern governance.

But the real issue is this: Can a government that does not fulfill its own responsibilities still justify taxing its citizens?

And specifically, in the Nigerian context, is it fair?

To answer this, we must first revisit where tax began.

The Origin of Tax: Where It All Started

The world did not always have industries, financial systems, technology, or structured economies. In ancient civilizations, rulers depended entirely on what their people produced. Society was simple - mostly agriculture, land, livestock, and labour - so the only realistic way a government could raise revenue was through taxation.

Ancient Egypt (c. 3000 BC)

- Farmers paid taxes in grain, cattle, and labour.

- Scribes documented harvests and determined each person’s contribution.

- Babylon & Mesopotamia People paid in agricultural produce, animals, and labour for irrigation works and temples.

Ancient China

- Taxes were collected in grain, cloth, and service.

- These funded walls, roads, canals, and armies.

Greece & Rome

- Tax systems grew more structured.

- Rome taxed land, goods, trade, and even slaves, using the revenue to maintain its vast empire.

Across all civilizations, the pattern was consistent:

- No industries.

- No oil.

- No technology.

- No advanced economy.

Taxation emerged because leaders had no other sustainable way to run society.

Tax Today: From Primitive Necessity to Social Contract.

Fast forward to the modern era, tax is no longer just a revenue mechanism. Today, taxation is a value exchange between citizens and their government. Citizens pay tax and, in return, expect:

- Job opportunities

- Security

- Good roads

- Water

- Functional hospitals

- Electricity

- Quality education

- Regulation and stability

- Protection of rights

In nations where governance is strong, citizens may not love paying tax, but they accept it because they receive value. They see the results of their contribution. There is fairness in the exchange.

The Nigerian Question: Is Taxation Fair? Especially the Personal Income Tax of 2026?

Nigeria is not a poor country by nature.

Nigeria is a rich country suffering from decades of mismanagement.

A nation with:

- Oil

- Gas

- Gold

- Zinc

- Limestone

- Coal

- Iron ore

- Bitumen

- Vast fertile land

A population of over 200 million energetic people. Yet citizens see little to no return from this wealth. So the debate is no longer about whether taxation is good or bad.

The debate is: Is it fair for leaders who consistently mismanage a country’s abundant resources to impose taxes on citizens who already receive nothing in return?

The answer is straightforward: No, it is not fair.

Tax becomes unfair the moment the social contract collapses. And in Nigeria, that collapse is clear, consistent, and longstanding. Taxation Without Governance Is Exploitation. When citizens must:

- Provide their own water

- Provide their own electricity

- Provide their own security

- Build roads within their communities

- Pay out-of-pocket for education

- Pay for quality healthcare

- Navigate insecurity alone

- Create their own economic stability

Then what exactly is the government providing in return for the taxes it demands? Nothing.

At this point in Nigeria, taxation is no longer governance, it is extraction. It is a system where citizens are indirectly forced to fund:

- Corruption

- Waste

- Inefficiency

- Overpriced projects

- The luxurious lifestyles of the political class

This is not taxation. It is exploitation disguised as civic responsibility.

Why Tax Origin Matters in Understanding Nigeria?

When you understand why tax was created in the first place, you understand why Nigeria stands out as a moral anomaly. Originally, tax was justified because ancient governments had no other way to raise money. But a modern country like Nigeria, blessed with vast natural resources and economic potential, cannot claim the same excuse.

The only reason Nigeria leans heavily on taxation is because the resources that should fund public services have been: Mismanaged, Wasted, Stolen and poorly accounted for. This is exactly why the conclusion becomes unavoidable: If the government mismanages the resources of a nation, it loses the moral right to tax its people.

Conclusion

Everything about taxation, from its ancient origins to its modern interpretation is built on the principle of exchange. Tax is not supposed to be a punishment. Tax is not supposed to be blind obedience. Tax is meant to be a fair contribution from citizens in return for value from their government. But when a government repeatedly breaks that value exchange, taxation becomes illegitimate. And in the case of Nigeria, this illegitimacy is glaring.

Nigeria is not a nation lacking natural wealth. It is a nation where natural wealth has been consistently mismanaged, diverted, wasted, and in many cases looted. The resources that should reduce the tax burden on citizens have been mishandled for decades, leaving the government dependent on squeezing citizens who already receive the least.

So let the truth be stated plainly: It is unfair for Nigerians to be taxed in any form. It is unfair for the Nigerian government to impose taxes on citizens while consistently mismanaging the nation’s abundant resources.

A government that does not provide security, water, electricity, healthcare, functional education, infrastructure, or economic stability has not earned the moral or practical right to demand tax.

In a nation where citizens finance their own survival, taxation becomes exploitation, not governance.

Therefore, based on historical context, economic logic, and the modern understanding of tax as a social contract, the conclusion is clear and undeniable: Nigerians are not supposed to be paying tax in a country where the leadership has repeatedly and consistently mismanaged its resources. Until Nigeria restores trust, accountability, and responsible management of its wealth, taxation will remain unjust, illegitimate, and fundamentally illegal.